WORKING CAPITAL FINANCING TO HELP YOU GROW YOUR BUSINESS

TAB Bank is an expert partner that understands your business, creates opportunities, and helps get the job done. We provide custom solutions specifically tailored to meet your needs.

Business financing that puts your business first. We take the time to understand your needs and industry.

Why work with TAB Bank?

We believe in honest banking for business.

When choosing a business bank partner, it's important to choose a company that you can trust. With over 20 years of banking and lending experience, TAB Bank is here to help. We offer no-nonsense banking focused on accomplishing your business goals for growth. Our greatest asset is our people. Our team cares about your company and works to deliver the best experience possible. Whether you need help with your business acquisition, keeping your company operating, or growing your business, TAB Bank is the right bank for you. We offer accounts receivable financing, business capital funding, and asset-based lines of credit.

Simple

Our easy-to-use technology and dedicated relationship managers will make your financing experience intuitive and hassle-free.

Reliable

A partner you can trust—we have the resources and security of a bank, with the proven expertise of a commercial lender.

Timely

Automated and online processing ensures you can get access to the cash flow you need, anytime and anywhere.

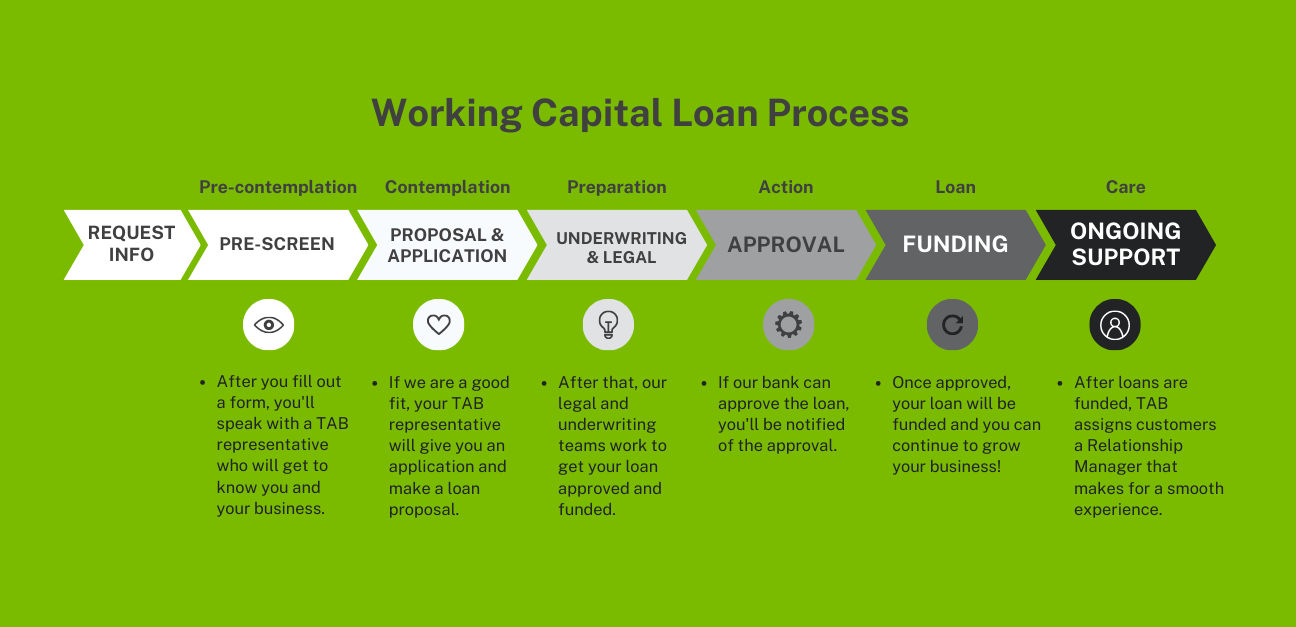

HOW IT WORKS

Working capital financing lets you transform your accounts receivable (A/R) and unpaid invoices into accessible cash flow for your business. Asset based lending monitors your A/R aging and provides a line of credit based on the amount of your outstanding receivables. Accounts receivable financing, on the other hand, allows you to sell your outstanding invoices for access to immediate cash flow for your business.

The type of working capital financing that is best for your business will depend on the amount of outstanding 30/60/90 day accounts receivable your company has, who your debtors are, and other factors that our sales and underwriting team can help to determine.

Simple and Straightforward Process

1. Whether you manufacture a product, transport freight, or hire out staff, you probably issue invoices with 30, 60, or 90 day payment terms.

2. TAB monitors or purchases the outstanding invoices as part of your working capital relationship.

3. With asset based lending, you are able to draw on your available line of credit at any time. With A/R financing, TAB holds the invoices until the due date and oversees collection of payments from your customers. TAB then pays you the remaining balance due from the invoice, minus a small service fee.

4. As your company grows, your approved credit line can increase to facilitate additional purchases, expenditures, and clientele.

Unlocking Dreams with Bold Financial Solutions

From manufacturing to staffing, logistics, and more, we understand that access to working capital is essential to maintaining and growing your business. TAB is on a mission to lift and empower small businesses through our full suite of financial solutions.

Working Capital Financing Options

Asset Based LendingLeverage your assets—including unpaid invoices, equipment, and inventory—for better cash flow management. An asset-based loan allows you to expand their borrowing capacity and enjoy lower interest rates with covenant-lite contracts, giving you significant liquidity to manage and grow your business. It's fast, affordable financing you can trust.

|

Accounts Receivable FinancingAccounts receivable financing lets you turn your outstanding invoices into immediately-available cash flow for your business. We offer personalized care with a relationship manager to help with funding requests, collection needs, credit management, and cash application. Send the unpaid invoices our way—we'll pay you upfront and take care of collections.

|

Small Business Term LoansIf your business does not have a business accounts receivables to leverage or if you would prefer a more traditional loan relationship, a small business term loan might be a fit for you. Whether they need $30,000 or $300,000 to grow their company or reach their next goal, our flexible terms and competitive rates can help get your business there.

|

Business Banking & Treasury ManagementSimplify your day-to-day business management operations with technology that lets you oversee your working capital and business banking from a single location. Our offerings are backed by experienced treasury management professionals and relationship managers who partner with you and help personalize your financial setup to align with your business goals.

|

Everything You Need, All Online.

TAB Bank is the lender you’ve been looking for. For more than 20 years, hundreds of companies have used us to improve their internal operations and get paid faster – and you can too.

Let's Find The Right Solution For You.

Wondering how we can help your business? Please fill out the form below to request more information and connect with one of our lending specialists.

This form is not an application for credit and you will not be asked to provide any confidential business or personal information (EIN, SSN, etc) at this point in the process.